Qualify Today

DSCR Quick Quote

Enter all the information below for a quick quote. Our quick quotes take about 1 business day and come with complete fee worksheets showing your rate, cash to close estimated, and monthly payment breakdown.

By Submitting, I Consent to Receive SMS Notifications, Alerts & Occasional Marketing Communication from company. Message frequency varies. Message & data rates may apply. Text HELP to (XXX) XXX-XXXX for assistance. You can reply STOP to unsubscribe at any time.

Learn More

What is a DSCR Loan?

A DSCR loan is a Debt Service Coverage Ratio loan. This loan type is geared towards real estate investors and focused more on the debt service coverage ratio (DSCR) of the investment than the borrower’s personal income. This means that a DSCR loan is based on the property’s income generation being able to cover the debt, instead of the investor’s ability to pay off the loan in their personal capacity.The investment property’s cash flow is the main component of a DSCR loan. This helps lenders and investors figure out whether the property’s net operating income (NOI) will cover the debt obligations of the loan. DSCR is the ratio used to measure cash flow, and it can be worked out by dividing the NOI by the amount of debt, on an annual basis.

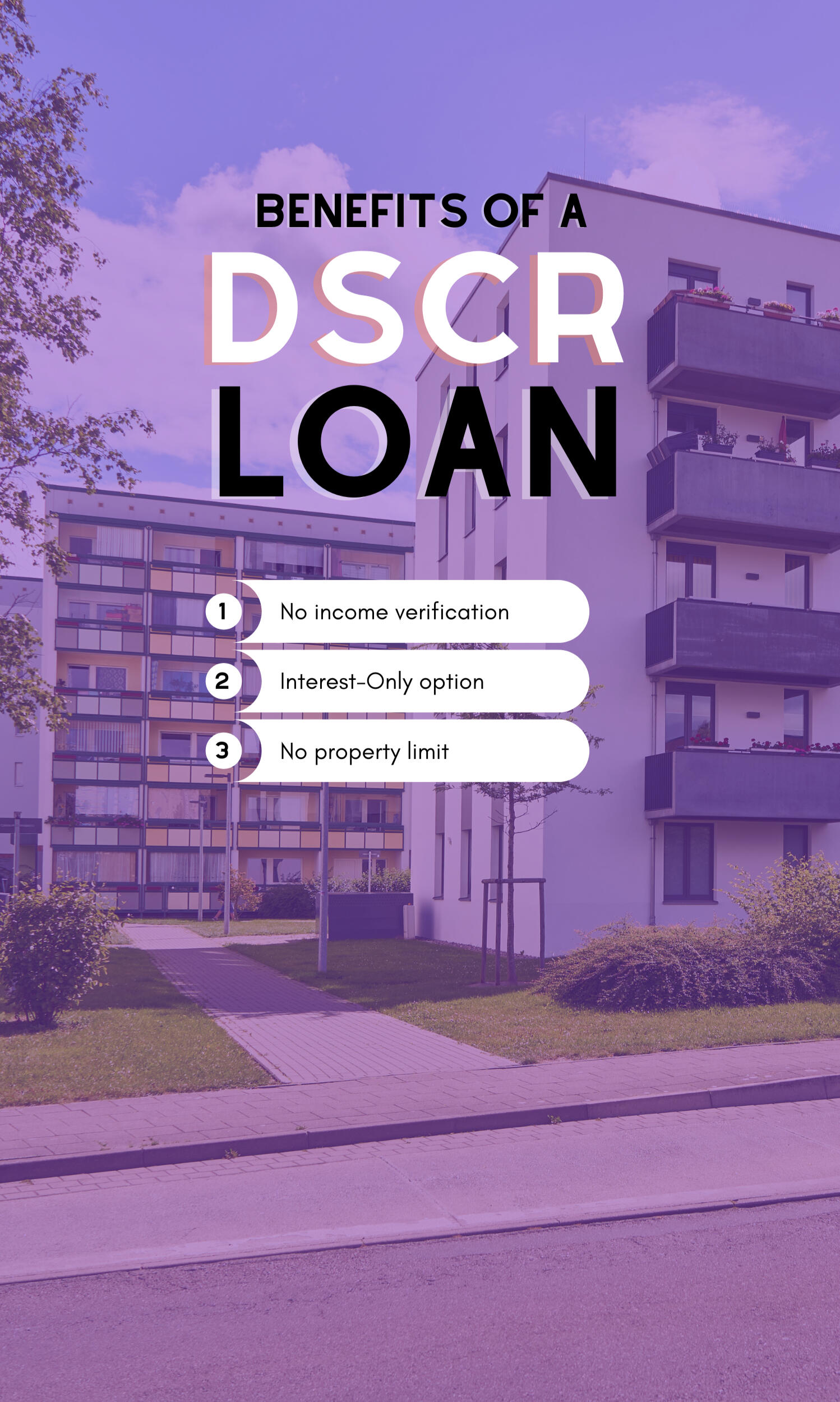

Benefits Of

DSCR LOANS

Personal Income Isn’t A Key Qualification Component: instead these loans are based on the cash flow of the rental property. If the net operating income can cover the debt with money to spare, it means the rental property has a positive cash flow and the loan is very likely to be approved.

No Income Verification: There is no employment check or income verification.

No Property Limit: There is often no limit to the number of properties that you can get financed with a DSCR loan. Many other conventional loans will place hard limits on the number of properties that can be financed, so this makes DSCR loans an attractive option for those wanting to expand their portfolio.

Can Fund Different Property Types: DSCR loans can be used for a variety of properties such as single-family residential properties, short-term and vacation rentals, commercial and multi-family properties.

Examples above shown marketing purposes only. Actual monthly payments may vary based on loan price, credit score, down payment, etc. Please contact a licensed loan originator for more information. Streamline Home Loans is a licensed trade name for Streamline, LLC. Corporate NMLS unique ID NMLS ID 14210 (www.nmlsconsumeraccess.org)

8345 W. Sunset Rd. #380 Las Vegas, NV 89113. 800-707-2830. This is not a commitment to lend. Buyers are advised to obtain a loan estimate. All loans are subject to underwriting approval. Rates are subject to change and are dependent on credit and underwriting criteria. Not all borrowers will qualify. Program qualifications and offerings are subject to change at any time. Equal housing opportunity.

Thank you!

Your form has been submitted!

One of our helpful loan officers will be contacting you shortly.

A quick quote is an estimate of what information is provided. To get started on your pre-approval letter, we will need a full application.Click "Start Now" to be taken to the application